Accounts Receivable Cornell University Division of Financial Affairs

Content

Payroll & fixed asset accountants looks after the processing of all the organisations’ payroll paying taxes on salaries, deductions for pensions, and social security subscriptions. Here are definitions of some accounts receivable terms as they are used in the online help. Search for accounts then view invoice and payment activity per account. For this reason, they are considered a “short-term asset,” which refers to any financial resource that can be converted to cash in one year or less. Explore our schedule of upcoming webinars to find inspiration, including industry experts, strategic alliance partners, and boundary-pushing customers. Whether new to BlackLine or a longtime customer, we curate events to guide you along every step of your modern accounting journey. Enable greater collaboration between Accounting and Treasury with real-time visibility into open transactions.

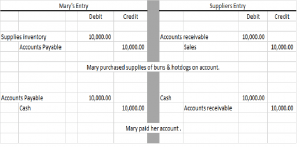

It is the job of a Accounts receivable professional to decide how much credit to grant a customer. Business B would record the same account as “payable” because they have an obligation to pay Business A.

Difference Between Payables and Receivables in Accounting

This situation occurs when customers who purchase on credit go bankrupt or otherwise do not pay the invoice. With today’s technological advances, companies can receive payment before shipping an order or performing a service. With service-based companies and high-cost goods, however, that may not always be possible. You will be able to evaluate their payment ability and set a credit limit you’re comfortable with. It also provides an opportunity to be sure both parties are clear on the payment terms and what happens if the account goes delinquent. This article is for small business owners looking to master their accounts receivable and handle client invoice payments. Quick generation of invoices and delivering them to customers is important and time-sensitive work.

- Instead, it will bill periodically at the end of the month for the total amount of service used by the customer.

- Porras said the lack of credit can force Latino business owners to make riskier financial decisions, such as relying on personal credit cards to grow their business, or taking out a loan on their accounts receivable.

- That is, they deliver the goods and services immediately, send an invoice, then get paid a few weeks later.

- The primary objective of AR management is to minimize day sales outstanding and processing costs while maintaining good customer relations.

- The days sales outstanding metric is used in the majority of financial models to project A/R.

- For accounts receivable, auditors look at accounts that are past due beyond 120 days.

- A dunning letter is a collection notice sent to a customer explaining that a payment they owe is overdue.

Offering them a discount for paying their invoices early—2% off if you pay within 15 days, for example—can get you paid faster and decrease your customer’s costs. If you don’t already charge a late fee for past due payments, it may be time to consider adding one. For comparison, in the fourth quarter of 2021 Apple Inc. had a turnover ratio of 13.2. But if some of them pay late or not at all, they might be hurting your business. Late payments from customers are one of the top reasons why companies get into cash flow or liquidity problems. If you do business long enough, you’ll eventually come across clients who pay late, or not at all.

How Does a Business Handle Accounts Receivable Collections?

Any adjustment to the Allowance account will also affect Uncollectible Accounts Expense, which is reported on the income statement. Uncollected debt – High A/R that goes uncollected for a long time is written off as bad debt.

- Accounts receivable departments play a critical role in processing invoices, keeping track of payments, and safeguarding income by confirming and publishing receipts.

- If a high concentration of your turnover is limited to a small number of customers, you may be at a higher risk of insolvency if that key source of income is lost.

- Get hands-on experience Experience the EMS one click at a time, in this gorgeous, all-encompassing, interactive demo.

- Some businesses will create an accounts receivable aging schedule to solve this problem.

- If you only react after the payment is missed, you could be leaving money on the table in that accounting cycle.

Between these two instances, you may need to follow up with the client to receive payment. Determine a process for performing accounts receivable, and stick to it. Choose another day to print an aged accounts receivable report and contact customers who are beyond their payment-term window.

What is accounts receivable financing (invoice financing)?

This has different implications, depending on the profit margins being generated. When https://personal-accounting.org/ generate substantial profits, then it makes sense to offer credit to most customers, because the profits are so large that they exceed the amount of bad debts. Conversely, when the profit per unit is quite low, a business cannot afford to have many bad debts, so it is extremely careful in extending credit to customers, resulting in very low accounts receivable.

Set up an accounts receivable process that maximises your chance of getting on-time payment. The amount that the company is owed is recorded in its general ledger account entitled Accounts Receivable.

What is an accounts receivable aging schedule?

The average time in terms of days between invoicing and payment is your DSO and is a good indicator of the efficiency of your receivables management. The status of each group reflects the time that has elapsed since an invoice was issued to the customer. The aging report will help the business organize and evaluate the status of its accounts receivable. A business that does not have an effective process for collecting accounts receivable will not have sufficient cash flow and may not be able to meet its basic obligations. To mitigate financial statement risk and increase operational effectiveness, consumer goods organizations are turning to modern accounting and leading best practices.

What are examples of accounts receivable?

An example of accounts receivable includes an electric company that bills its clients after the clients received the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills.

The first step involves adding the balance for accounts receivable at the beginning of the reporting period to the balance at the end and dividing by 2. This produces the average value of accounts receivable for the period. Once a business has evaluated its accounts receivable, it can implement a strategy for collections.

When to call something ‘bad debt’

As payments are collected, your cash balance is debited, or increased, while accounts receivable is credited, or reduced. Collecting timely payments is critical to effective management of accounts receivable to maintain a strong cash flow.

- For finance leaders, excellence in accounting practices, managing cash flow, producing better reporting and maximizing working capital are top of mind, and both AR and AP are fundamental to all of these.

- Most B2B billing hinges on accounts receivable, so standard invoicing practices make for great accounts receivable examples.

- You can try to minimise these with – for instance – credit insurance, factoring, or bonds, at least until the new service or customer has become established.

- To properly forecast A/R, it’s recommended to follow historical patterns and how DSO has trended in the past couple of years, or to just take an average if there appear to be no significant shifts.

- Some finance companies will pay you up to 90% of the value of an invoice if you sign it over to them.

If you bill your clients hourly, invoicing that client every hour, day or even week would quickly become tedious for both parties. Instead, you’re likely issuing monthly invoices and expecting payment within 60 days. The value of your invoice, which represents a month’s worth of work, is part of your accounts receivable. To determine profitability, add up all your assets, including accounts receivable, and subtract your total accounts payable, or liabilities, which are what you owe to suppliers and vendors.